At the October 28, 2010 Vancouver Greentech Exchange, Mike talked about investment options for investors, challenges for entrepreneurs, incentives and impediments to innovation and finally explained a new investment vehicle – GreenAngel Energy Corp – could benefit both investors and entrepreneurs. Here is a summary of Mike’s talk:

I’ve been investing in start-ups for almost 30 years after selling my own company, one of the first University of Waterloo spin-offs. My main interest is capital formation for start-ups.

After my presentation, there will be short talks given by six clean tech companies that are all part of GreenAngel Energy Corp. >

.

.

.

These companies/websites and presentations are as follows:

These companies/websites and presentations are as follows:

Habitat Carbon Assets [Habitat Presentation]

DPoint Technologies [DPoint Presentation]

Light-Based Technologies [LBT Presentation]

Paradigm Environmental [Paradigm Presentation]

Rapid Electric Vehicles [REV Presentation]

Delaware Power Systems [DPS Presentation]

.

.

.

I’m going to cover the investment options that are available to investors in general, the sources of funding for entrepreneurs, some incentives and impediments in the funding ecosystem and finally, a solution in the form of a new publicly-traded investment company – GreenAngel Energy Corp.

.

.

.

.

So, where can investors get a decent return these days?

So, where can investors get a decent return these days?

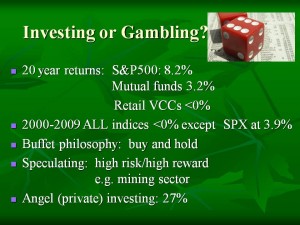

The 20 year returns (annualized rates of return) are pretty dismal. The SP500, for example, which reflects the broader stock market returned only 8.2%. Investing in an exchange-traded index fund like the SP500 is probably one of the best ways to invest in the stock market. If you let managers pick your stocks, as in the case of index funds, you would generally not do as well as mutual funds returned only 3.2% (this info is from a recent Globe and Mail article titled “Why you should be an investor, not a gambler“. Part of this is because they take healthy annual fees in the 3% range. Here, in BC, the so-called retail Venture Capital funds and labor-sponsored funds (that are also tax-assisted) are all in negative territory. If you take a shorter time horizon, your chances of overall returns are even less. In the 2000-2009 period, all major indices, except the TSX’s SPX index were all giving investors less than even money.

If you want to speculate in penny stocks, the time frame is much shorter and the risk/reward ratio much higher. But, hey, that’s what built the mining sector here in B.C. Why can’t we do that for tech companies?

If you take the Warren Buffet approach, you’ll identify good prospects and then patiently wait for returns. In essence, this is what private “angel” (i.e. rich people) do when they invest in private companies. Sometimes, investors have to wait 5-15 years for an exit.

There are not many clean-tech companies that the small retail investor can buy into. Here are a few that I follow. Many of these are not tech companies but, rather, they are independent power producers such as Naikun and Plutonic Power Corp. Plutonic is a company that I helped found over 10 years ago. It has raised hundreds of millions of dollars of capital and has invested this in run-of-river and wind power projects in B.C. It was originally a speculative stock and it hit almost $10 from pennies. Strangely, now that it has real contracts and real revenue – in fact, great cash flow of around 50 cents/share, it’s trading at a measly $2.00 which just goes to show that the markets are fickle and volatile – so you’ve got to be patient. A lot of my friends who bought Plutonic ask me almost daily why the price has gone down and remains low. All I can say is to be like Buffet and be patient.

There are not many clean-tech companies that the small retail investor can buy into. Here are a few that I follow. Many of these are not tech companies but, rather, they are independent power producers such as Naikun and Plutonic Power Corp. Plutonic is a company that I helped found over 10 years ago. It has raised hundreds of millions of dollars of capital and has invested this in run-of-river and wind power projects in B.C. It was originally a speculative stock and it hit almost $10 from pennies. Strangely, now that it has real contracts and real revenue – in fact, great cash flow of around 50 cents/share, it’s trading at a measly $2.00 which just goes to show that the markets are fickle and volatile – so you’ve got to be patient. A lot of my friends who bought Plutonic ask me almost daily why the price has gone down and remains low. All I can say is to be like Buffet and be patient.

As for tech companies, there are not many public in which you can invest. I’d like to see many more of these. One of those on the chart is Ballard (TSX:BLD) – the public market allowed investors to get in and it gave the company the capital it need to prove (or not) its business case. Investors who are keen on green don’t have that many investment opportunities available to them.

Let’s now turn our attention to entrepreneurs who need start-up capital to get their ventures launched.

Let’s now turn our attention to entrepreneurs who need start-up capital to get their ventures launched.

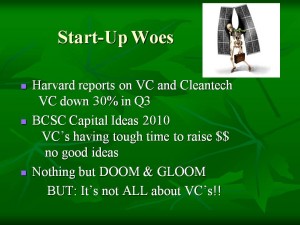

The Canadian Venture Capital Association recently reported that in Q2 of 2010 only $300 million was invested Canada-wide in tech companies (all tech – not just clean tech). Even worse, venture capitalists raised only $250 million of new money to invest.

In contrast, some $2 BILLION was raised through private placements from investors in Canada according to regulatory filings. This includes private and public companies but excludes all the investment from family, friends and angel investors who did not even report on their investments.

The Pacific Institute for Climate Solutions put out a white paper recently that basically says that the clean tech sector in B.C. will be hampered by the lack of venture capital.

I was down in Silicon Valley last week and heard many comment that Venture Capital was down substantially from the boom years.

I was down in Silicon Valley last week and heard many comment that Venture Capital was down substantially from the boom years.

A recent Bloomberg report noted that green start-ups were trapped in the “Valley of Death” – with no early commercialization funding available to them. One of the clean tech VCs – VantagePoint Venture Partners – has channeled more than $5 billion into start-ups, including one of our GreenAngel companies – Light Based Technologies Inc. which recently received $7.5 million from VantagePoint and from local clean tech VC, Crysalix Energy Venture Capital. Unless there are more IPOs (initial public offerings) like the June, 2010 offering by Tesla Motors (NASDAQ:TSLA), the VCs will have a tough time raising new money. An October 1 report from San Francisco;s Cleantech Group notes that VC clean tech investments fell by 30% in the third quarter to $1.53 billion (US-wide). By the way, Tesla raised $226 million and is now trading at 23% above its initial offering at $17.

Earlier this week, the BC Securities Commission held its “Capital Ideas 2010” conference in Vancouver. It was noted again that venture capital was drying up and we weren’t seeing many IPOs. For that matter, one panelist noted that many companies go public much too early. I didn’t hear of any new “ideas” – especially relating to capital formation for start-ups.

With all due respect to VCs – it’s NOT all about them. In fact, I estimate that between 10 an 100 times as much capital is available from private individual investors.

It was also noted at the BCSC conference that in B.C. there are incorporated 391,000 businesses. Of these, 216,000 have no paid employees and only 7,000 have more than 50 employees. It points to the need for early stage and growth stage funding.

Angel investors are individuals who invest in start-ups and often give them a helping hand as well. They are usually successful entrepreneurs. Most often, they also fit the definition for “accredited investor” – this is a legal definition determined by securities regulators (e.g. the B.C. Securities Commission). Basically, it means that a person has over $1 million (not including home) in capital to invest or a substantial annual paycheck (over $200K).

Angel investors are individuals who invest in start-ups and often give them a helping hand as well. They are usually successful entrepreneurs. Most often, they also fit the definition for “accredited investor” – this is a legal definition determined by securities regulators (e.g. the B.C. Securities Commission). Basically, it means that a person has over $1 million (not including home) in capital to invest or a substantial annual paycheck (over $200K).

In Vancouver, the VANTEC Angel Network has been operating since 1998 and hundreds of angel investors have invested many millions of dollars into hundreds of companies. A recent report on angel investing in B.C. has just recently been completed [click here for a copy]. Much of this type of investment activity is not tracked or reported, but just from what I see and hear, the amount invested by angels is anywhere from 10 to 100 times that invested by VCs.

Rob Wiltbank of Willamette University (see my post on Angel Returns) studies angel investing in North America and from a sample of over 1,000 angel-backed ventures has found the average annual rate of return to be 27% – a very impressive number.

However, as Wiltbank’s chart shows, over half of the companies fail early and produce little or no return (left blue bar). However, a small number can produce huge multiples – more than 30 times the original investment.

From my own experience, you never know which companies will make it and which ones will fail. Sometimes, very promising ones disappoint while marginal ones surprise.

To get that 27% return, you need to be in many deals. Angel “funds” are becoming more popular. These provide a way for several investors to invest in several companies. There are very few of these. I started a private one for accredited investors in 2003. This one is called WUTIF Capital (VCC) Inc. We have over 150 investors in it and have invested over $5 million in more than 50 start-up companies. Of these, only one has produced an exit. We had a few companies that were almost acquired in 2008 but then the market tanked and these acquisitions were postponed. However, more than half of the companies are performing well and we should enjoy Wiltbank-like returns over the long run.

In the “Angel funds 101” slide I show 6 companies and values similar to the GreenAngel portfolio and the exit multiples that could be achieved using a distribution similar to that of the exits studied by Wiltbank. A valuation of $16.8 million in 5 years would provide a whopping 52% annual rate of return. A mere doubling in that same time period would equate to a 15% IRR – which is still well above stock market returns. One big gripe among angel investors is a lack of liquidity – many invest with an expectation of getting an exit (eg IPO or buy-out) in 3 to 8 years but more often than not – it takes more than 10 years to get a liquidity event.

In the “Angel funds 101” slide I show 6 companies and values similar to the GreenAngel portfolio and the exit multiples that could be achieved using a distribution similar to that of the exits studied by Wiltbank. A valuation of $16.8 million in 5 years would provide a whopping 52% annual rate of return. A mere doubling in that same time period would equate to a 15% IRR – which is still well above stock market returns. One big gripe among angel investors is a lack of liquidity – many invest with an expectation of getting an exit (eg IPO or buy-out) in 3 to 8 years but more often than not – it takes more than 10 years to get a liquidity event.

.

.

Funds such as WUTIF are organized as VCCs – Venture Capital Corporations – under the BC government’s Small Business Venture Capital Act. These are special investment companies that can, thanks to the B.C. government, give investors resident in B.C. a 30% REFUNDABLE Tax credit. Investors can invest up to $200,000 each year. They can even use money inside their RRSP accounts to get the 30% tax credit personally without paying any taxes at all!

Funds such as WUTIF are organized as VCCs – Venture Capital Corporations – under the BC government’s Small Business Venture Capital Act. These are special investment companies that can, thanks to the B.C. government, give investors resident in B.C. a 30% REFUNDABLE Tax credit. Investors can invest up to $200,000 each year. They can even use money inside their RRSP accounts to get the 30% tax credit personally without paying any taxes at all!

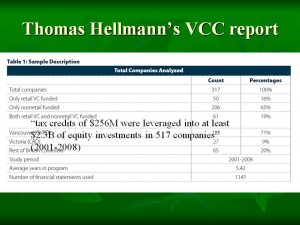

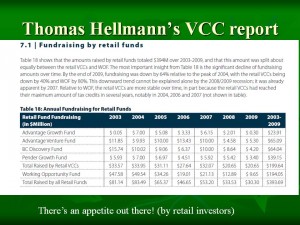

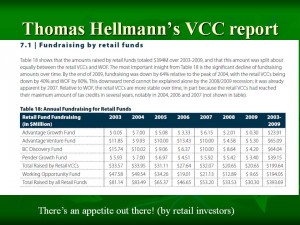

Tons of money has been raised – $2.3 billion was invested in 517 companies using the leverage of tax credits as studied by UBC Professor Thomas Hellman. For a copy of his report, [click here].

.

In addition to the many (more than 100) VCCs that were formed, eligible companies can also offer tax credits directly to investors. Of all the VCC funds that were formed, four large “retail” ones were created using a prospectus offering that allowed them to sell to man-on-the-street retail investors. They raised almost $200 million from the public. Unlike many start-up investors, these retail VCCs behaved more like traditional Venture Capital investors with the usual management fees and high overhead burden. Hellmann’s chart also shows that a labor-sponsored fund raised a similar amount from retail investors. This shows that there is capital available even though none of these funds has yet to provide a positive return to investors.

In addition to the many (more than 100) VCCs that were formed, eligible companies can also offer tax credits directly to investors. Of all the VCC funds that were formed, four large “retail” ones were created using a prospectus offering that allowed them to sell to man-on-the-street retail investors. They raised almost $200 million from the public. Unlike many start-up investors, these retail VCCs behaved more like traditional Venture Capital investors with the usual management fees and high overhead burden. Hellmann’s chart also shows that a labor-sponsored fund raised a similar amount from retail investors. This shows that there is capital available even though none of these funds has yet to provide a positive return to investors.

.

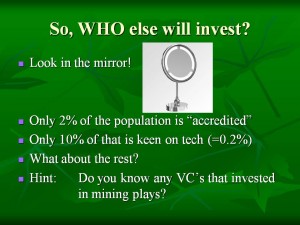

. So, in addition to Venture Capital funds and VCCs and accredited investors, WHO can invest in our exciting clean tech start-ups? Look in the mirror! Only 2% of the population meets the accredited investor standard. Of that 2%, at best 10% are inclined to invest in tech start-ups (based on tech sector to GDP ratios). That’s only 0.1 to 0.2% of the population.

So, in addition to Venture Capital funds and VCCs and accredited investors, WHO can invest in our exciting clean tech start-ups? Look in the mirror! Only 2% of the population meets the accredited investor standard. Of that 2%, at best 10% are inclined to invest in tech start-ups (based on tech sector to GDP ratios). That’s only 0.1 to 0.2% of the population.

How was the mining sector in B.C. financed? Do you know any VCs that invested in mining plays? No – it was the general public. Not accredited investors or institutions – just run of the mill average investors that like to speculate a little in hopes of a high return. Why can’t we do that for the tech sector?

.

Now, let’s look at things from the perspective of the entrepreneur. There are many sources of funding available. For a list of some of these [click here]. In Canada and in B.C. we are particularly fortunate to have some great incentives – ranging from the popular SRED (Scientific Research and Experimental Development) that gives companies up to 68% cash-back on R&D salaries to outright grants and tax credits.

Now, let’s look at things from the perspective of the entrepreneur. There are many sources of funding available. For a list of some of these [click here]. In Canada and in B.C. we are particularly fortunate to have some great incentives – ranging from the popular SRED (Scientific Research and Experimental Development) that gives companies up to 68% cash-back on R&D salaries to outright grants and tax credits.

Here are two examples that illustrate how these incentives can be stacked to facilitate capital formation: Two angel-backed companies, General Fusion Inc and Rapid Electric vehicles, raised money from investors using a special purpose VCC that would raise capital from many investors and invest it all in one target company. Fusion Energy VCC invested in General Fusion and REV Technologies invested in Rapid Electric Vehicles. Investors in one of these VCCs would get back the 30% VCC tax credit AND they could put their shares into an RRSP to give them another (up to) 44% in tax savings. In the case of Fusion Energy, investors were also told that if the initial experiments failed, some of the 68% in SRED rebates could flow back to them on dissolution. In essence, it meant very little risk and lots of upside for early investors. (WUTIF is an investor in General Fusion and GreenAngel is an investor in REV)

There’s a lot of talk these days about innovation and commercialization and what Canada needs to do to be more globally competitive. In September, the Coalition for Action on Innovation produced a paper that I helped author. To get the complete report along with some media coverage, [click here].

There’s a lot of talk these days about innovation and commercialization and what Canada needs to do to be more globally competitive. In September, the Coalition for Action on Innovation produced a paper that I helped author. To get the complete report along with some media coverage, [click here].

Start-ups need people (first) and capital (second). While incentives are great, why don’t we just get rid of some of the barriers? One of the barriers on the people side is the absurd taxation on an unrealized benefit when employees are recruited and given stock or stock options. On the capital side, securities regulators make it very difficult for companies to sell shares to anyone other than close friends or accredited investors (remember that 0.1% number). For more discussion on these impediments, [click here]. At the affore-mentioned Capital Ideas 2010 conference, I asked about why it is so difficult for companies to tap into the general public’s purse. I was told that the so-called “Offering Memorandum” exemption from a prospectus requirement could be used. However, that takes several weeks and costs several thousand dollars – an audit is even required if the company has no financial history. It simply doesn’t work for a start-up requiring small amounts of seed funding. David Baines, who does a great job of exposing scam artists in his Vancouver Sun columns, once wrote about how Offering Memorandums are used very effectively by scammers because it lets them go after the naive public. Red tape and regulations do not prevent dishonesty.

In the meantime, what can be done to address two key issues: 1)getting more investors (big and small angels) into the start-up arena and 2)give all investors liquidity so they don’t have to tie up their money for 5 to 15 years.

In the meantime, what can be done to address two key issues: 1)getting more investors (big and small angels) into the start-up arena and 2)give all investors liquidity so they don’t have to tie up their money for 5 to 15 years.

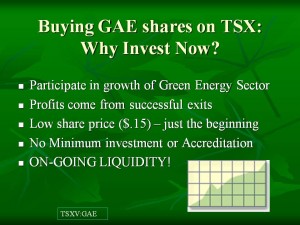

Answer: a new, publicly listed (and tradeable) angel fund that anyone can invest in without red tape. GreenAngel Energy Corp was launched in October, 2009, as the first such fund. It trades on the TSX Venture Exchange under the symbol, GAE. You can look it up on Yahoo Finance. As the name implies, this fund focuses on clean (green) and energy-related technology ventures. There’s no reason we can’t use a similar approach to invest in biotech, media, medical devices, Web2.0, etc start-ups.

As this fund grows and experiences some exists, it can re-invest in more and more green energy companies with a view to becoming a substantial player in this market.

The people involved in GreenAngel all have experience as entrepreneurs and investors in start-ups. The GreenAngel website will give you more information oin their backgrounds.

The people involved in GreenAngel all have experience as entrepreneurs and investors in start-ups. The GreenAngel website will give you more information oin their backgrounds.

GreenAngel started life as a “CPC” – a Capital Pool Company as defined by the TSX Venture Exchange. CPCs are created by investors as vehicles for taking companies public as an alternative to a full-blown IPO. A CPC can raise up to $2 million, I believe, and then merge with another company, thereby taking it public. CPCs are a classier approach to the old RTO (Reverse Take Over) scheme whereby defunct public companies do a merger which results in the acquired entity’s shareholders now being in control of the merged company (hence, the term, RTO).

When we formed GreenAngel, our intention was to use it to give us an exit on one of the promising 50+ companies in the WUTIF group. However, we came to realize that those companies that would do well in the public market really didn’t need to go public because they could readily raise capital privately. On the other hand, those companies that wanted to go public were simply too early and not, in our humble opinion, ready for the public market.

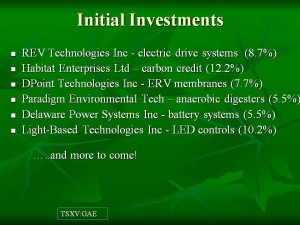

The six companies that GreenAngel initially selected were at different stages in their development with different exit strategies. Some could be great public companies while others are more niche-oriented and ideal for a merger transaction with a larger entity.

The six companies that GreenAngel initially selected were at different stages in their development with different exit strategies. Some could be great public companies while others are more niche-oriented and ideal for a merger transaction with a larger entity.

We also selected these 6 because their respective founders were all willing to trade some of their shares with GreenAngel shares thereby making them all investors in GreenAngel and partners, so to speak, with one another. This has resulted in some meaningful information sharing and collaboration within the group.

We also picked some in this group because we believe that they are poised for an early exit – sometime within the next 1-3 years.

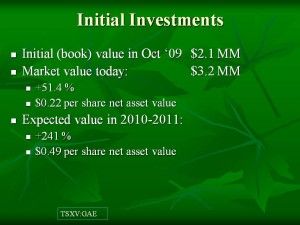

GreenAngel, being a start-up in its own right, started small with approximately $2.1 million invested in the six companies. Most of these companies have been (or are) raising additional capital at much higher valuations. Dpoint just closed a $2.5 million investment from a European strategic partner and Light-Based Technologies received $7.5 million from VC investors. Earlier this year, Delaware Power raised $4 million. The other three companies are presently in fund-raising mode. Based on the increase in share price, GreenAngel already (at least on paper) shows more than a 50% increase in its asset value.

GreenAngel, being a start-up in its own right, started small with approximately $2.1 million invested in the six companies. Most of these companies have been (or are) raising additional capital at much higher valuations. Dpoint just closed a $2.5 million investment from a European strategic partner and Light-Based Technologies received $7.5 million from VC investors. Earlier this year, Delaware Power raised $4 million. The other three companies are presently in fund-raising mode. Based on the increase in share price, GreenAngel already (at least on paper) shows more than a 50% increase in its asset value.

.

.

Of the six, only Paradigm has produced an Offering Memorandum to attract a broad number of investors. And, it worked. Paradigm has raised $13.5 million. The others are raising their capital mainly from VCs and Angels. What this means is that unless you are accredited, the only way (for now) for you to buy into these companies is by buying GreenAngel shares.

Of the six, only Paradigm has produced an Offering Memorandum to attract a broad number of investors. And, it worked. Paradigm has raised $13.5 million. The others are raising their capital mainly from VCs and Angels. What this means is that unless you are accredited, the only way (for now) for you to buy into these companies is by buying GreenAngel shares.

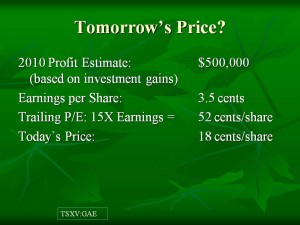

Currently, because we’ve not done much in the way of public or investor relations, the shares have been trading in the $.15 to $.20 range.

Investors can invest by buying treasury shares from the Company (if they are accredited) or simply by buying on the market if they are not accredited. The former provides new capital while the latter facilitates liquidity.

Who knows what our shares will be worth in the future? This will depend on the performance of the companies in building their values and on how good a job we do at publicizing the results. We know that “promotion” has a negative connotation – especially in the Vancouver market – but, let’s face it, even Apple and RIM have to promote themselves all the time.

Who knows what our shares will be worth in the future? This will depend on the performance of the companies in building their values and on how good a job we do at publicizing the results. We know that “promotion” has a negative connotation – especially in the Vancouver market – but, let’s face it, even Apple and RIM have to promote themselves all the time.

As an investment company, we should be able to report the appreciation in value of our investments as gains and include these gains in the calculation of earnings.

Our year-end is November 30th and we expect to show good results in our first year of business.

.

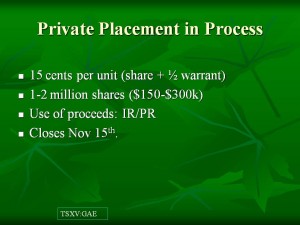

For accredited investors, we’re conducting a private placement. For 15 cents, investors can buy one unit. Each unit consists of one share and one-half share purchase warrant. One whole warrant permits the holder to buy one share in GreenAngel for 20 cents during the first year and for 25 cents during the second year. Between 1 and 2 million units are being offered up to November 15, 2010.

For accredited investors, we’re conducting a private placement. For 15 cents, investors can buy one unit. Each unit consists of one share and one-half share purchase warrant. One whole warrant permits the holder to buy one share in GreenAngel for 20 cents during the first year and for 25 cents during the second year. Between 1 and 2 million units are being offered up to November 15, 2010.

We expect this to close when either the 2 million target or the Nov. 15th date is reached. The proceeds will be used mainly to create investor interest and awareness.

.

.

In conclusion, we’re very excited about this new initiative. We think it can be one way to attract a broader base of investors into an emerging new field – green energy – to commercialize new technologies while at the same time providing on-going liquidity.

In conclusion, we’re very excited about this new initiative. We think it can be one way to attract a broader base of investors into an emerging new field – green energy – to commercialize new technologies while at the same time providing on-going liquidity.

We hope that, you too, will become a green angel!

.

.

.

October 30th, 2010

October 30th, 2010  Mike

Mike

Posted in

Posted in  Tags:

Tags: